There always comes a time when I feel like I have to organize my life a little bit. That includes me cleaning out the computer’s desktop, deleting all my un-read emails, sorting them out into folders and realizing how much unnecessary sites I am getting messages from that cluster my mail box. A couple months ago when I was on a roll organizing I decided to start writing down my expenses to see where and how could I save some extra money. During the months, this is what I learned from my notes. I decided to share them because they might be able to help you as well!

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

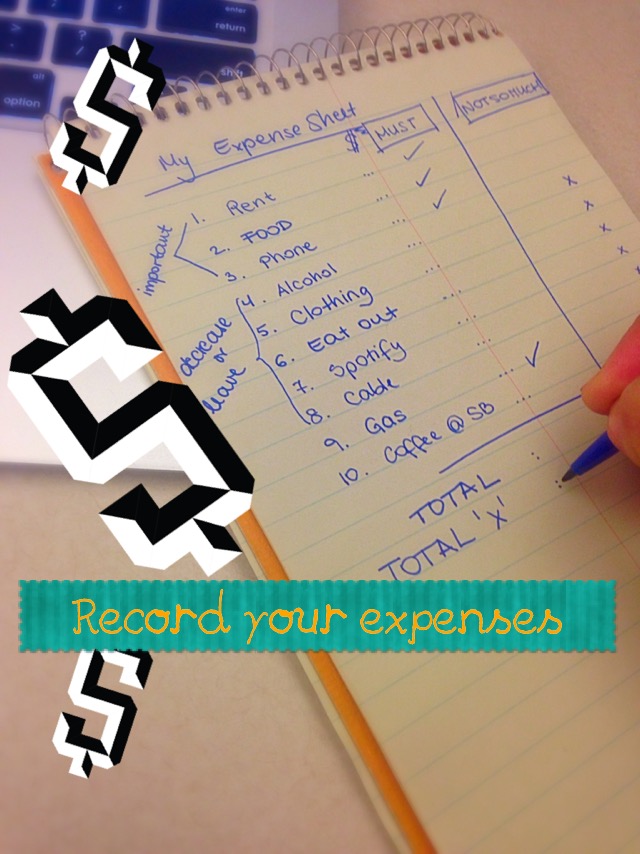

- Record your expenses (for a month or so) to see what are those extras that you can easily cut out of your life. Prioritize what is really important to you and what is not so much.Writing down what my expenses were for two months helped me a lot to figure out where a chunk of my money went. Yes, it gets a little tedious and can be annoying but it really is worth the effort. There are many different phone apps (The best 7 apps according to Daily Worth) and websites ( The 10 best and free online budgeting tools according to Good Financial Cents) where you can record your expenses! Of course, if you don’t want to deal with these, you can use a plain piece of paper or an Excel sheet can do the magic too. I used a very bogus little piece of paper, all I wanted to see was how much the unnecessary numbers get up to…turns out, quite a lot.

-

Create a savings account and put 10-15% of your paycheck towards it. If you can’t do 10-15%, then go with whatever you feel like you can do but make sure to commit to it! It might be a little amount but they will add up in the long run and you will always have a little money to rely on if something comes up.

You might be going: duuuh, a savings account! Thanks for the tip genius but I know how I thought about this when I was younger. I kept saying I will do it, it can’t be as important, and I also took money off of it very often, in fact so often that the bank changed it back to a checking account. Eek. Well in this case, there is no point to having a savings account. Make sure to put an amount to the side that you can live without with no problem and you don’t run out of money by the end of the month. Even if that money is a tiny amount, don’t worry about it, it will add up!

-

Phone bills

I heard some people got rid off their smart phones, to save money. To me that is a little extreme. I am way too attached to my smart phone because that is the only device that keeps me in touch with my family and friends back in Hungary throughout the day; Viber, Skype, iMessage, it would be hard to do without those. I am on a plan with my friends and had a contract of $50/month. The contract expired after two years, but since I took good care of my phone (I got a Lifeproof case that is pretty pricey but saved my phone million times, therefore saved me hundreds of dollars), instead of upgrading, I kept my current phone. There is not one scratch on it and it works perfectly fine but my monthly bill went down from $50 to $32. That is $18 savings each month. That might not seem like a whole lot, but it is something!

-

Coffee and tea

Buying coffee or tea in a shop every day can cost you a LOT! If we count with $3 on average, and 5 days a week that would equal to $60 A MONTH!!! But if you must pay a visit to Starbucks every day, make sure to get the phone app and take advantage of your discounts and occasional free coffee coupons.

I have a friend whose high school economic teacher pointed out two girls from the class because they went to class with a Starbucks drink every single day. They spend on average $5 a day on fancy frappes and mochas. The teacher added it up and it turned out that with the money they spent on Starbucks coffee during the school year they could have bought a roundtrip flight ticket to Europe. That is a very eye opening example.

-

Cancel Automatic payments for different websites

Two years ago I ordered a pair of boots from a website for a great price but I didn’t realize that the great deal came with monthly commitments of a $35 auto payment. I was able to skip the auto payment each month but of course life happens and sometimes I forgot to take care of it. I didn’t want to cancel it because I felt like I did not want to miss out on the upcoming deals later on but it just never happened and the auto payment kept taking my money if I didn’t pay enough attention. So throughout the months I lost $70 on that deal and then realized that I don’t use their services enough to worth risking it (Took me way too long to give up on that but I did eventually) There comes an extra $35 each month!

-

Prepare lunch and eat out less

Not preparing lunch to work can cost you $8-12 each day 5 times a week which is about $10×5=$50 a week x 4 = $200 a month….holy cow!!!! Invest in a crockpot and prepare food for the week! Meal prep is not only healthy but budget friendly as well. Here is a geat website for amazing crockpot meal ideas for meat lovers, vegeterians, gluten intolerants etc.

I know it is great to go out sometimes so I am not saying stop doing that completely. Have a budget for going out/month and make sure you don’t go over that. -

Don’t throw your coins away

My husband’s friend in high school had a jar and put every coin in it that he found on the ground during the school year. By the end of the school year he had an extra $27. While that is a little extreme I also met friends who threw away their coins because the coins are “annoying”. Don’t be that guy! Have a jar or a piggy bank and put your coins in there. In a year we collect about an extra $50 dollars with that.

-

Go grocery shopping with a list and a FULL stomach

Instead of going through the store and wandering without a purpose (which makes everything very desirable especially if you are hungry), go with a purpose and make sure you eat before so you don’t wanna buy and eat up the entire store. That will save you some money, trust me!

-

Take fewer cab rides and use more public transportation

However, I understand this is not too appealing, this can save you a whole lot of money. I admit, in America this is way harder to accomplish than back in Europe where most cities have great public transportation system. If you must, choose Uber or Lyft and save yourself some money.

-

Look for clothes on sale and sell back your least favorite pieces

Do some winter clothes shopping in the spring, or summer outfit shopping in the fall; look for clothing items on sale instead of full price! There are also great websites that take your clothes that you don’t use anymore so you can make money off of them. Another option is to donate those, there are many people out there who whould be very grateful for that piece of clothing you haven’t even looked at in years.

-

Get rid of cable and switch to Netflix or Hulu

Cable cost $30-100ish a month and Netflix cost $8.99 a month, while Hulu cost $7.99. Figure out if you can make those changes based on your needs because this can actually save you a whole lot of money. Also if you have a friend or family member, you can split the cost of the Netflix account and get it together.

-

Get creative during the holidays

Make your own gifts, use Google for ideas, there are lots of great and fun ideas on Pinterest for example. Get creative and create some memorable presents instead of just taking the easier road and buying another sweatshirt…or if you are really against that at least agree on a reasonable budget with your spouse instead of spending hundreds of dollars

-

Drink water at restaurants

In my sophomore year at college, my tennis coach came up with a new rule where we weren’t allowed to drink anything else but water at restaurants. Now, she created the new rule so we don’t drink a bunch of sugary and terrible liquid before our matches but it made her realize that each time we ate, we saved like $20. That adds up to be $120 on a long weekend which is huge. I understand that your family is probably not 11 people but it still can save you some money each month.

You can make your own lemonade in a restaurant too, by ordering water and lemon and adding sugar or sweetener to it. It tastes great and it is FREE! -

Lights off

Turn off the lights when you leave the room. I noticed that people in America have the habit of leaving the lights on in every single room they appear to be in, or they leave the TV on when leave the house. To save money with the lights, turn them off when you leave the room, switch to LED, which might be a little more expensive, but lasts longer and saves you money on your electric bill. Turn the TV off when you leave the house! Also, and I make this mistake during winter months, don’t let your water run for a long time before you get in the shower.

-

Do I really need this?

Such an important sentence. If you are shopping online or in a store make sure to take a step back and count to 5…in some cases to 10 so you get a chance to actually think through whether you need that item or not. Making an emotional snap decision is very easy but you might regret it later. Take a deep breath, think it through, and ask yourself: Do I really need this?

-

Pack food for road trips

This is not only helping you to stay on track with your diet or healthier eating habits, it will also help your wallet. Prepare fruit and veggies, make sandwiches for the road or by bulk products and distribute them into small ziplock bags…instead of buying stuff at the gas station for ridiculously expensive prices, use this option to save money.

-

For Pete’s sake, quit smoking

People spend hundreds of dollars on smoking, it is not only a horrid habit that can ruin your health, but it is also an expensive hobby. How about putting all that money towards traveling or doing something much healthier? Is it hard to quit? Well, your health must be motivating enough for you to suffer through those couple days at the beginning. You will see how much better it feels to spend all that money on a great experience somewhere on a cruise ship or just buying more groceries, maybe pay back loans etc…

-

Alcohol

Well, I know this is going to be an unpopular one, but the truth is that some people spend hundreds of dollars on alcohol each month. College students too…those college students who always complain they have no money for anything, but somehow spend at least hundred dollars on alcohol during a weekend. I know them because I went to school with them. So be smart about it. I am not saying to quit drinking but have a reasonable budget and geez don’t spend $100 on a Saturday night, c’mon!!!!! ooor…if you do, just don’t complain later….

What do you think of these saving options? Just with some of these options I saved about $356 a month.

Do you have other tips and trick that you could add to this list? Do you have another approach or a different way to save some money? Please comment below!

Hope these were helpful to you!

Love this, I am all about saving money and being resourceful! Invest in reusable products to use around the home like tupperware instead of plastic bags, microfiber towels intead of paper towels or to cut your usage of them, cloth napkins instead of paper, consider making some or all of your household cleaning or cosmetic products as you buy ingredients in bulk and it ends up being about 10x less expensive and you also cut out all the unnecessary chemicals, buy clothing from thrift or consignment stores (they have great stuff, you just have to look), use cloth diapers, they even have “period underwear” now and yes they work!

LikeLike

These are such great ideas! Thank you 🙂

LikeLike

Ez drágám egy nagyon ütős írás. Ügyes vagy! Ha a feleslegesen elszórt pénzt megtartod, az mind-mind gazdagabbá tesz, hisz amit nem adtál ki, az növeli a bevételed!

Én a háziállatra elköltött pénzt tette volna még bele: a házi kedvencnek is megvesznek az emberek egy csomó felesleges mütyürt. Lehet szeretni úgy is állatot, hogy a szükséges dolgokat kapja meg, de abból jó minőségűt!

LikeLike

Bizony bizony…Echo is az ures uveggel jatszik szivesebben, mint a dragan megvett pluss macival haha

LikeLike